Gas market overview Q4 2025

Gas Prices Fall, Weather Risks Remain

- Prices at Multi-Year Lows

- European Gas Storage: Adequate, but With a Narrow Margin for Error

- Q1 Gas Market Outlook: Price Action Hinges on Weather

Prices at Multi-Year Lows

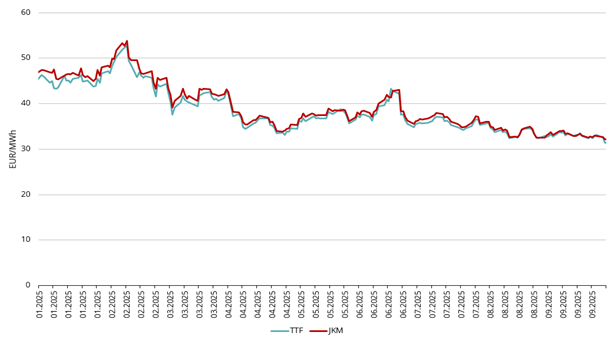

After a relatively calm September and October, European gas prices declined sharply in November and early December. The ICE Endex TTF front-month futures price closed Q3 at 31.41 EUR/MWh and fell to a low of 26.53 EUR/MWh in December — the lowest level since April 2024 (see Fig. 1).

Mild weather and ample supply were the primary drivers of this price movement. Milder-than-average winter temperatures across much of Europe reduced heating demand, while strong LNG inflows, cancelled cargoes, and weak Asian demand added further downward pressure.

The average price of the ICE Endex TTF front-month benchmark during Q4-25 was 30.15 EUR/MWh, approximately 9% lower than in Q3, despite the onset of the heating season. Forward contracts for the nearest full month, February 2026, closed at 28.16 EUR/MWh on December 31. The forward curve remained in backwardation, with the nearest month trading at the highest level — around 29 EUR/MWh — while summer contracts traded closer to 27 EUR/MWh (see Fig. 2).

A defining feature of Q4 was weak demand in key Asian markets, particularly China, where LNG imports failed to grow year-on-year as previously forecast. In addition, Pakistan and Egypt cancelled multiple LNG cargoes for Q4 and 2026 due to affordability constraints and domestic demand issues, releasing additional volumes onto the spot market and contributing to further price pressure.

Late in the quarter, the EU signaled a strengthened commitment to phase out Russian gas imports, including LNG, under the REPowerEU strategy. A provisional agreement between the Council and the European Parliament confirmed a stepwise prohibition, with Russian LNG imports set to be fully phased out by 1 January 2027 for long-term contracts and earlier for short-term agreements. This policy crystallizes the EU’s long-term diversification objectives and reinforces expectations that Russian LNG will increasingly be redirected toward alternative markets — primarily Asia — thereby freeing up more Atlantic Basin LNG for European demand.

European Gas Storage: Adequate, but With a Narrow Margin for Error

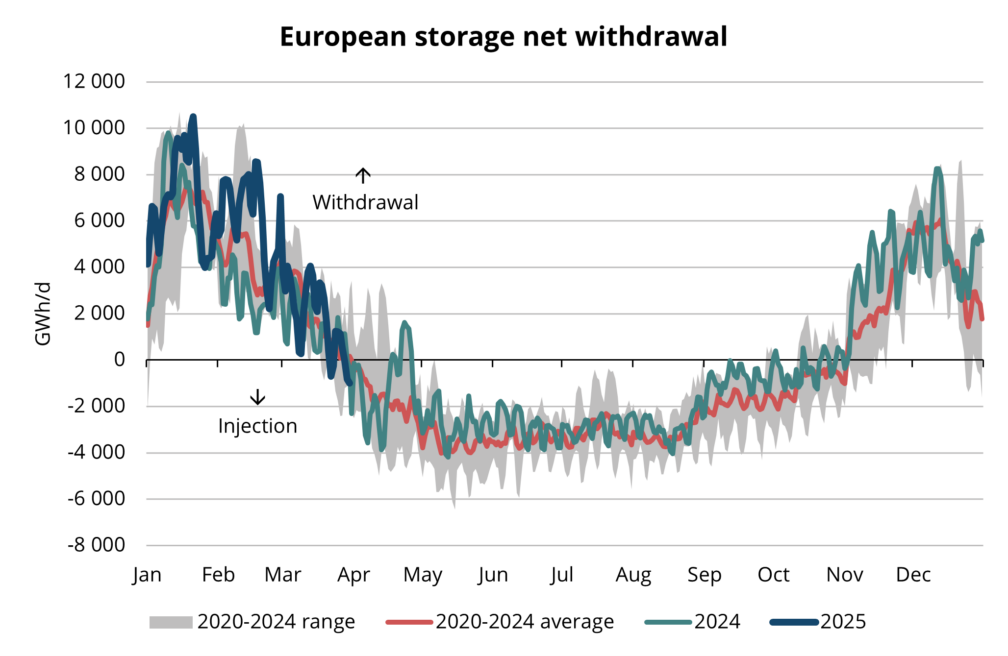

At the start of the 2025–26 withdrawal season on 1 October, EU gas storage levels stood at approximately 83% of working gas capacity — broadly in line with pre-crisis years but clearly below the five-year seasonal average for that point in the year. While EU storage regulations target a 90% fill level ahead of winter, inventories in 2025 remained below this benchmark (European Commission). By late December 2025, average EU storage had declined to around 63%, reflecting seasonal withdrawals amid the heating season (see Fig. 3).

While mild weather during Q4 ensured supply adequacy, the system’s margin for error remains limited. In the event of a prolonged cold spell, faster-than-normal storage withdrawals could quickly tighten market balances, particularly if compounded by LNG supply disruptions or infrastructure outages. Indeed, late November and December saw elevated withdrawal rates (see Fig. 4), making storage dynamics a key variable to monitor as the market moves into Q1.

At the same time, strong LNG import levels helped mitigate some of these concerns (see Fig. 5). With weaker competition from Asia and expanding regasification capacity across Europe, LNG inflows increased markedly compared with the same period last year, as price spreads consistently favoured European landings over Asian diversions. By year-end, Europe had imported nearly 30% more LNG than in 2024, providing an important counterbalance to lower storage buffers.

Robust LNG inflows enabled Europe to make up for lower storage levels and capping potential price spikes. Nevertheless, storage levels could be tested in the event of a prolonged cold spell or widespread infrastructure disruption during Q1 which leaves the door open for potential price spikes.

Q1 Gas Market Outlook: Price Action Hinges on Weather

An unusually cold end to 2025 and start to 2026 led to stronger-than-expected withdrawals from European gas storage, highlighting the sensitivity of the market to weather conditions. As Europe moves into Q1 2026, gas price dynamics are expected to remain predominantly weather-driven. With storage levels lower than in recent winters, the market has limited buffer capacity to absorb prolonged cold spells. Should colder-than-normal conditions persist into late winter, or if Europe experiences a delayed cold snap in February or March, TTF prices could react sharply upward, reflecting tighter balances and accelerated inventory drawdowns. Conversely, the main downside risks stem from milder and windier weather, which would suppress gas demand for heating and power generation and allow inventories to last more comfortably through the remainder of the winter.

Geopolitical and infrastructure risks remain an important underlying factor for energy markets. Attacks on critical energy infrastructure continue to pose a persistent threat, with Russian strikes on Ukrainian gas facilities ongoing and Ukraine increasingly targeting Russian energy assets in response. Beyond Eastern Europe, rising tensions in the Middle East — particularly involving Iran — alongside escalating political frictions in Latin America following recent U.S. actions against the Maduro regime add further layers of uncertainty. While these developments have not yet resulted in direct disruptions to global gas flows, they contribute to an elevated geopolitical risk premium across energy markets. In this environment, gas prices remain highly sensitive to headlines, with market sentiment able to shift rapidly even in the absence of immediate physical supply losses.

This market overview is for informational purposes only. We aim to compile the most relevant data from various sources in good faith but the analysis should not be treated as an advice or taken as the sole basis for any action.