Gas market overview Q3 2024

Summer saw volatile gas prices

- Prices continue to rise in Q3 2024

- Europe once again enters Winter with strong storage levels

- Europe well prepared for the Winter ahead, but volatility remains

Prices continue to rise in Q3 2024

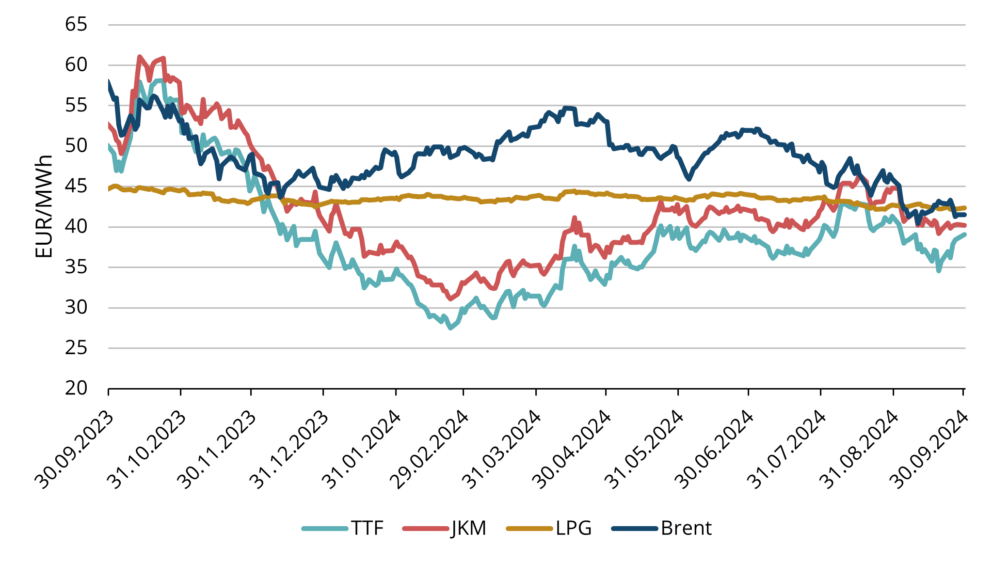

After a sharp downtrend from October 2023 through the end of Q1 2024, gas prices began to recover in Q2 and continued climbing into Q3 2024. The ICE TTF Front-Month futures reached their highest point on August 12th, peaking at 42.50 EUR/MWh. Q3 was characterized by significant volatility: prices initially fell in July but surged by around 40% from mid-July to mid-August, hitting a previously mentioned peak. This rapid rise was largely driven by concerns over Russian gas flows through Ukraine, following Ukraine’s surprise incursion into Russia’s Kursk region, where they gained control of the Sudzha gas transit station.

Additionally, rising tensions in the Middle East added to the uncertainty, with intermittent strikes throughout the quarter. However, once Russian gas flows stabilized, the market calmed, and prices fell roughly 19% from their August highs to their lowest point on September 19th. Yet, renewed tensions in the Middle East and forecasts for colder weather in Europe sparked another upward trend, driving prices up by about 20%.

Geopolitical factors aside, Europe and Asia also experienced strong summer heatwaves, increasing demand for cooling and further supporting gas prices. Throughout Q3 2024, the average European natural gas benchmark, the ICE Endex TTF front-month price, stood at 35.60 EUR/MWh. By the end of the quarter, the ICE TTF forward price for November 2024 closed at 39.04 EUR/MWh on September 30th.

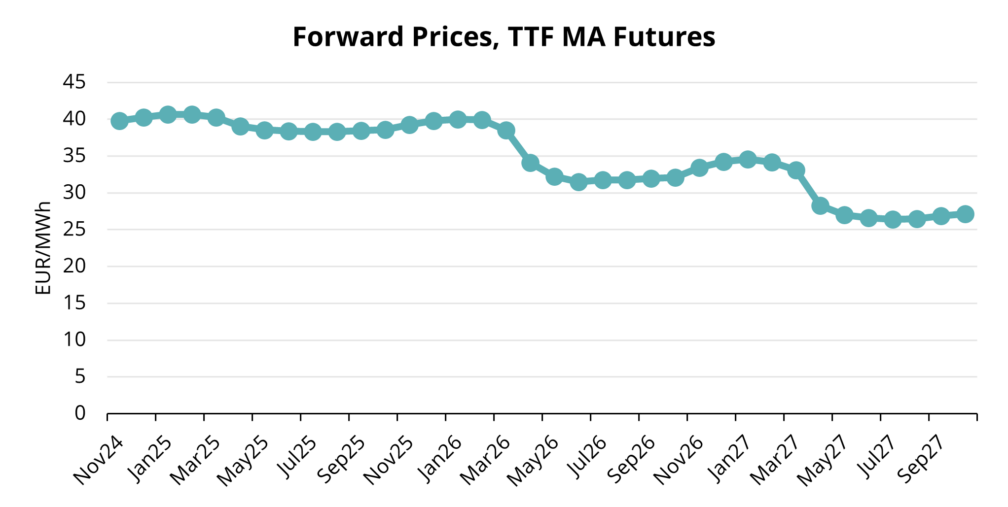

The forward curve for natural gas remains remarkably flat throughout the winter months, with all contracts trading around €40/MWh (see Fig. 2). This level is consistent with where prices stood at the end of Q2, indicating that winter pricing has remained largely unchanged. Interestingly, Summer 2025 prices are only slightly lower, hovering around €38/MWh. This relatively flat curve suggests that the market is calm and not particularly concerned about physical supply shortages this Winter. However, this also means that any disruptions to the current supply-demand balance could lead to a sharp widening of spreads, as the market may quickly react to unexpected volatility.

Europe once again enters Winter with strong storage levels

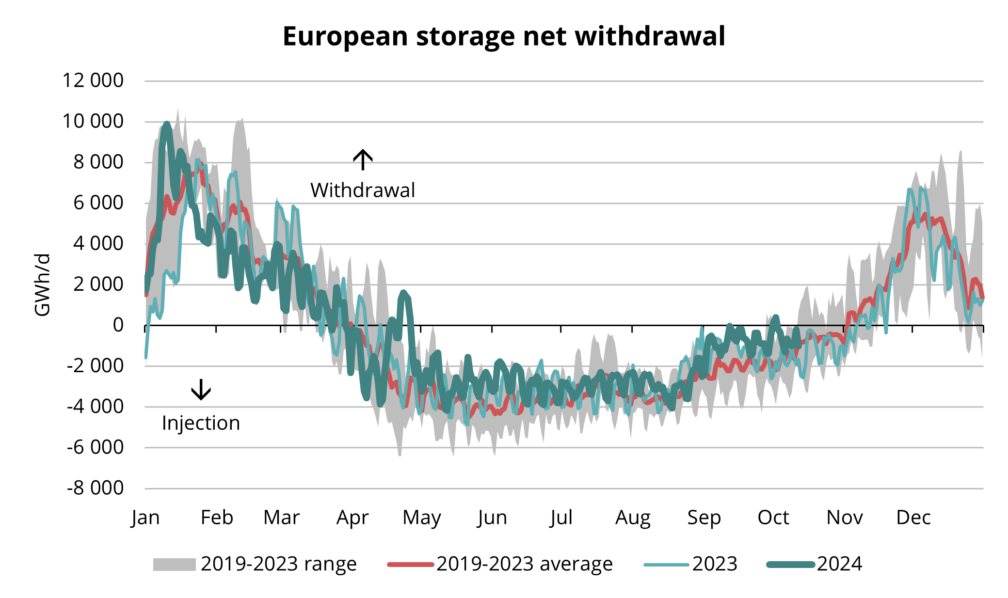

Once again, Europe heads into winter with robust gas storage levels. During the summer, the primary focus for the gas market is to fill storage facilities to ensure sufficient supply for the winter season. This year, Europe began the injection season at historically high levels, thanks to a relatively mild winter last year. As a result, the pace of injections throughout the summer was slightly slower than the 2019-2023 average (see Fig. 3).

With Q4 marking the start of the withdrawal season, October serves as a transitional period between injection and withdrawal. Typically, withdrawals in Europe begin from late October to early November. The timing depends on the price curve, as market participants tend to draw on stocks during months with higher prices – usually between November and March. This year’s forward curve supports the same pattern, signaling that withdrawals are expected to occur from November to March.

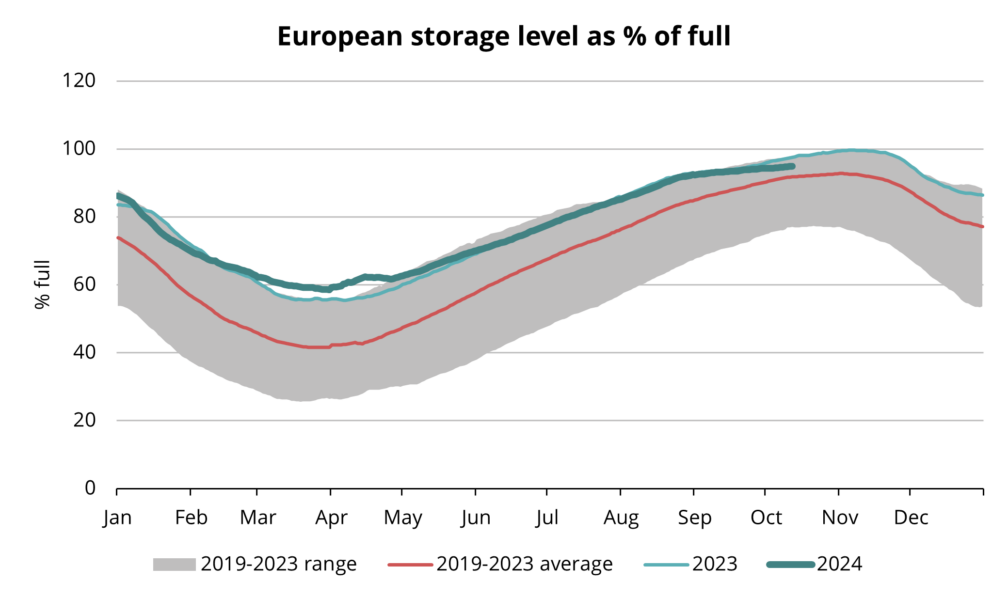

Despite a slower injection pace this summer compared to previous years, European gas storage facilities were once again filled to near maximum capacity. By the end of September, storage levels had reached approximately 94% (see Fig. 4), which is higher than the 2019-2023 average and very close to last year’s figures. This high storage level provides market participants with confidence that Europe is well-prepared for the upcoming winter season.

Europe well prepared for the Winter ahead, but volatility remains

Industrial demand is still rather weak in Europe, but residential, commercial and power sectors are expected to drive gas consumption to increase by around 10% year-over-year in the NWE region (Bloomberg). It is driven by the colder-than-normal winter weather forecast. If the current forecasts materialize then NWE storages will be around 40% full in the end of withdrawal season. This is much lower than this year when NWE storages were over 55% full before injection season. Market could be underestimating the winter supply risk as we haven’t yet seen cold winter after Ukraine-Russia war and if cold winter would indeed materialize then prices would have to rise. However, in case of mild winter prices would likely drop to the levels seen last winter. Therefore, as usual, weather is the most crucial factor for gas prices in winter season.

In addition to weather, another factor which affects gas prices in the months ahead is geopolitical risks. Firstly, Ukraine-Russia transit deal of moving Russian gas via Ukraine ends this year and there is close to zero probability of this continuing. However, there have been talks if these remaining Russian flows to Europe can be redirected via Azerbaijan pipeline. This is a topic which is still open but will definitely have an impact on gas prices in Europe. If this deal happens then it is a major bearish factor for gas prices. Although the current supply structure would not change immediately on paper then it would open the door to the question that if Europe accepts this deals and recognizes these flows as Azerbaijani gas, not Russian gas, then why couldn’t the flows coming from there be double or triple of those coming via Ukraine pipeline currently? Because theoretically Russia could increase the flows to the Azerbaijan which could be redirected to Europe, meaning bigger Russian gas flow to Europe. On the other hand, if the deal gets blocked then Europe needs more LNG to cover for the losses from the disappearance of Ukraine pipeline gas. Some of it will come through Turkey, but a significant amount would need to be replaced by LNG. This would mean faster withdrawals in Winter and higher need for injections during Summer – these combined would put a price pressure on entire front end of the curve.

Europe is well-prepared for the upcoming winter, with gas storage levels near maximum capacity and ample LNG terminal infrastructure across the continent. Many LNG terminal slots remain unused as there has not been enough demand for the gas at the price levels where some of the terminals would be economically viable. These aspects combined mean that Europe has enough storage and LNG capacities to secure the physical gas supply. However, despite this readiness, prices are likely to remain volatile. The global geopolitical landscape remains fragile, and energy markets are always highly sensitive to weather fluctuations, especially in Winter.

This market overview is for informational purposes only. We aim to compile the most relevant data from various sources in good faith but the analysis should not be treated as an advice or taken as the sole basis for any action.